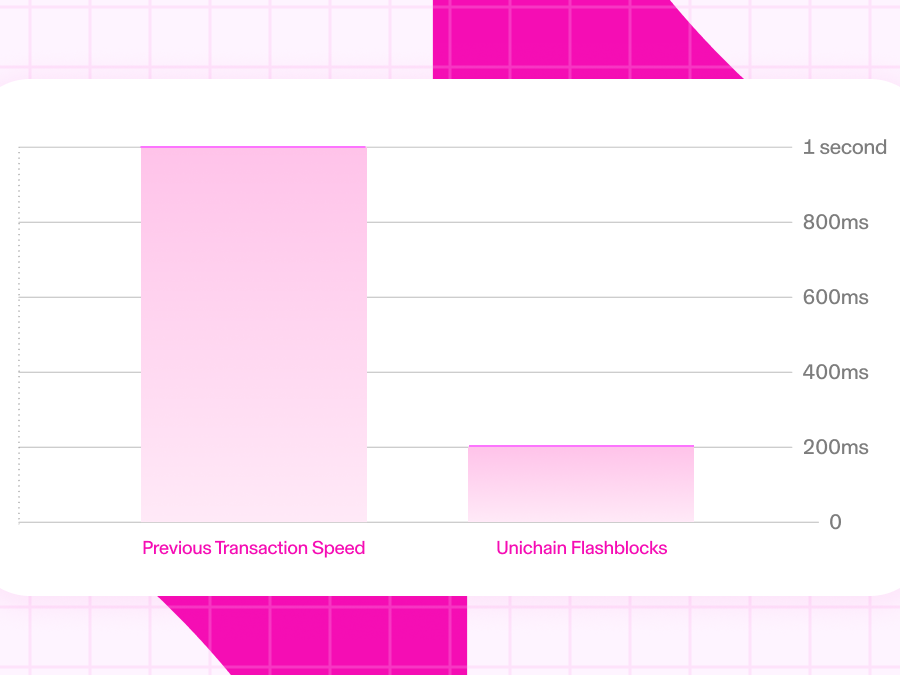

Speed is essential for efficient onchain markets. It’s why Unichain launched with 1s block times and why we worked with Flashbots to help push the entire L2 space toward 200ms sub-blocks. But speed alone doesn’t make markets efficient. Chains need to be fast, fair and verifiable, and interoperable – and that’s exactly how we’re building Unichain.

Speed is just the start

Shorter block times don’t just improve user experience, they make markets work better. Fast block times allow prices to update more frequently, reducing the window for stale execution and narrowing the gap between onchain and offchain markets. The result is tighter execution for swappers and less value leakage for liquidity providers.

Research from Uniswap Labs shows that full-range LPs on faster chains earn around 20% more in arbitrage-adjusted returns than on Ethereum Mainnet. That improvement comes from faster price resolution, more frequent onchain updates, and reduced lag between price discovery and execution.

Speed also enables more responsive liquidity. With lower latency, LPs can rebalance more often, leading to tighter concentration around market prices and more efficient capital use. By reducing idle capital and enabling faster reactions, Unichain helps create deeper, more dynamic markets across DeFi.

Making sequencing fair and verifiable

Onchain markets need more than just speed to achieve efficiency, they also need to be fair and transparent. On Unichain, fairness starts with how transactions are sequenced. Unichain uses priority ordering and block building happens inside a trusted execution environment (TEE).

But fairness isn't just about setting the rules, it's also about being able to prove they're being followed. That’s why the TEE was designed to support public attestations. This will allow anyone to independently verify that blocks were constructed as intended ‒ improving fairness, reducing reliance on the sequencer, and representing a meaningful step toward a more decentralized Unichain.

This kind of predictability and verifiability unlocks new ways of returning value back to users that are uniquely possible on Unichain, opening up a new design space for protocols to leverage the strong guarantees that come with verifiable priority ordering. For example, verifiable priority ordering makes it possible to implement mechanisms like dynamic fee hooks based on priority fees at the time of execution. This reduces value leakage for LPs and makes markets more efficient by aligning fees with real-time demand.

Unifying liquidity across Ethereum, and beyond

Even optimized infrastructure falls short when liquidity is fragmented across chains.

As part of the Optimism Superchain, Unichain is working with OP Labs to implement native interoperability, enabling single-block cross-chain messaging and unlocking seamless interoperability across Superchain L2s. For ecosystems beyond the Superchain, Uniswap Labs co-authored ERC-7683, the first cross-chain standard designed to solve liquidity fragmentation through a universal filler network.

This infrastructure reduces fragmentation and sets the stage for a more unified onchain experience, allowing capital to move freely between networks.

More than speed

Unichain delivers more than speed. It combines fast blocks for more efficient markets, fair ordering to reduce MEV, public attestations for verifiability, and cross-chain infrastructure to unify fragmented liquidity.

To stay updated on the latest Unichain news, follow @Unichain on X/Twitter.